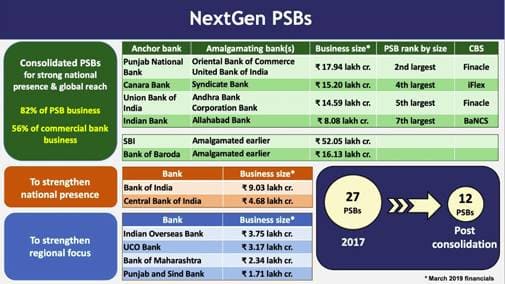

30-08-2019 would be remembered as a significant date in the history of the Indian Banking system. Government has finally taken a decision on the bank merger, bringing the total number of Public Sector Banks to 12 from 27. The next few months are going to be very important for the banking community as there will be major changes in the face of PSU banking industry in India. But there are a few things that PSU bankers should note in the wake of mergers:

What is the new face of PSU Banks in India?

It is not decided if the names of the merged banks would be retained or changed. However, the tag of ANCHOR BANK gives an idea that the merged entity would maintain the name of the Anchor Bank, like in the case of merger of SBI and associated banks, and in case of Bank of Baroda with Dena Bank and Vijaya Bank.

Things PSU bankers should keep in mind:

- LESSON FROM PREVIOUS BANK MERGER: this is not the first time that we are seeing mergers of banks. So, we have the story of SBI and BOB as an example. What we have observed from the previously cases of mergers of PSU banks is that the picture is not so bad. In fact, the banks, which were merged, were offered better facilities and infrastructure in the new bank. This might be the silver lining to most of us.

- THERE IS NO VICTORY or FAILURE IN THIS: While it’s true that banks are being merged, and some PSU banks might loose their identity after the completion of the merger process, we should not feel too excited or depressed. Mergers and acquisitions are a part of the economy. The basic framework of all the PSU banks is the same across the PSU sector. Thus, we should avoid having preconceptions about the ongoing process, and just accept the fact that mergers have real;

- ONCE A BANKER ALWAYS A BANKER: as a banker, our loyalty and attachment should be to our profession. We have seen a number of instances of people experiencing stress due to major changes in the parent organization, but we should take such changes positively. Remember, we are first a PSU Banker.

- WHAT ABOUT BIPARTITE SETTLEMENT? This might not be a pretty picture. With all the merger process on its way, it would become a valid reason for further delay in the finalization of bipartite settlement for PSU banks. Further, the government appears to be in favour of coming up with a new wages formula that might be introduced soon. But the suspense prevails and possibility of the 11th BPS happening in the near future looks weak.

- IS THIS PRIVATISATION? There is no denying the fact that PSU banks are moving towards privatisation at an unprecedented speed. It might be a step towards further corporatization of the PSU Banks, but it is not necessary. In the case of SBI and BOB, the execution of merger did not fast forward the speed of privatisation. The speed of privatisation is directly controled by the government and RBI, the future of privatisation would be dictated by them only.